I have worked in payroll recruitment for over 20 years. During that time, I have lost count of the times a payroll professional has told me they have “fallen into payroll”. Perhaps this was the case historically; however, we are now seeing people proactively opt to pursue a career in payroll, and I think this is significant because it highlights how far the industry has come.

The Covid pandemic has also accelerated a change in perspective towards payroll. Payroll professionals were rightly praised as they worked tirelessly to keep the UK paid after over 11.7 million employee jobs were put through the furlough scheme at the cost of £70billion. World leaders, such as the Australian Prime Minister, Scott Morrison, even publicly thanked the efforts of payroll practitioners “for playing your part in what has been an extraordinary effort.” As a result, payroll has been thrust into the limelight, and with it, we have seen an explosion of new payroll career pathways open within the industry.

The World Economic Forum released an article in 2020 reporting that advances in automation and AI would displace 85 million jobs and create 97 million new ones by 2025. Meanwhile, the Pandemic essentially created the largest payroll home-working experiment of all time, proving that payroll professionals can deliver results from remote locations. Many process-led transactional payroll positions have subsequently been replaced by automation and technology. Meanwhile evolving AI and advances in analytics, remote working capabilities and reward initiatives have resulted in a plethora of new payroll career pathways coming to the fore.

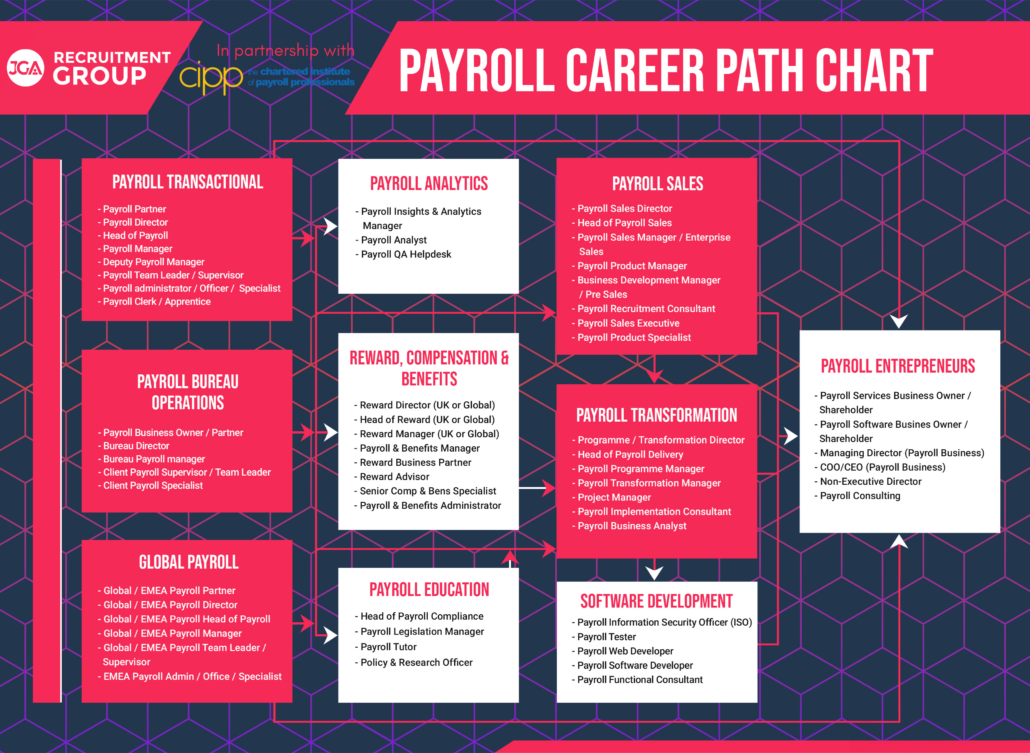

In collaboration with the CIPP, JGA Recruitment Group decided to undertake a research project to discover how many different payrolls career pathways now existed, and the results may surprise you. We successfully identified over 60 current career pathways for payroll professionals.

As businesses seek to become more employee-centric and more profitable against a backdrop of rapid change and transformation, payroll skills have been forced to adapt and evolve in response. For example, payroll job descriptions have become more strategic and analytical and less process-driven than they used to be. In addition, as organisations strive to improve efficiency, compliance, systems, employee wellness, and data analytics, companies have started to demand more from payroll operations and providers.

Payroll departments handle a businesses’ most significant operating expense – employee wages. In addition, payroll departments manage and collect more data than almost any other business function. With data now considered one of the most valuable resources globally, it is no surprise that the profile of payroll has increased as organisations begin to appreciate the influence that effective payroll strategy and efficiency can have on performance. It is why we see more brands than ever before asking us to support them with payroll director-level hires. As a result, payroll is beginning to find its feet at the C-Suite level, representing a massive shift in appreciation for the sector.

Meanwhile, European payroll and HCM markets are estimated to be valued at over £25 billion. Where there is profit, there is opportunity. SME start-ups and Enterprise level providers seeking to sell solutions related to cloud management, payroll data security, global payroll complexity or systems efficiency are finding they need to recruit to keep up with demand. Subsequently, we have seen many new payroll sales roles enter the market, from business development managers and payroll customer success professionals to payroll sales directors.

As the new age of automation and AI develops, payroll responsibilities continue to augment in response. As a result, payroll career opportunities in implementation consultancy, change management and project management are increasing. Meanwhile, post-transformation, organisations understand that knowing how technology works (and how to leverage it for maximum value) is equally critical; hence the demand for internal payroll system managers, global payroll specialists and payroll data analysts has also soared.

The much-publicised “Great Resignation” is a genuine phenomenon that has impacted the payroll profession. We have secured a record number of payroll vacancies that have materialised because employees have chosen to leave one employer for another. The critical reasons behind these resignations relate to workplace flexibility, inconsistent leadership, career progression limitations or remuneration. However, the great resignation has not been restricted to the payroll profession. Across all industries, talent is on the move, and in response, companies are working hard to create attractive packages that can entice top talent to join them as they try to scale and grow. This battle for talent is impacting the payroll industry as we have witnessed a stark rise in the demand for payroll professionals with hybrid expertise in reward management. Companies want people who can link pay and performance with organisational goals to help them attract and retain talent. Subsequently, mixed payroll and reward type roles are becoming popular as companies seek to develop pay and benefits provisions that can meet the needs of their diverse workforces.

Finally, as payroll positions change, skills evolve, compliance changes and technologies advance, payroll training providers have become the pivotal hub on which payroll professionals rely as they seek to develop the skills required for this new world of work. Subsequently, new career opportunities have arisen for payroll tutors, legislation managers, and policy writing professionals.

I have always likened the payroll professional to that of a Chameleon. My view is that the payroll community has always adapted and evolved no matter the pace or scope of change ahead. However, it appears that payroll is finally starting to shake off its out-of-date number-punching, big red button, wages clerk tag. Instead, it is shedding its transactional camouflage, and it is putting itself at the epicentre of employee engagement, data management, technology, OPEX efficiency and compliance. With over 60 career pathways to choose from right now, payroll professionals are no longer restricted by glass ceilings or transactional tasks. Payroll has gained chartered recognition as a pivotal business function that can hugely influence and drive value to support broader organisational objectives.

As a result, people are no longer “falling into payroll”; instead, and perhaps for the first time, people are proudly and proactively selecting payroll as a career choice because of the many exciting and varied opportunities the industry now provides. Moreover, there are now more routes than ever before to enable this choice to become a reality. People may choose to undertake a payroll apprenticeship, or perhaps they will study for a payroll degree or postgraduate qualification. Others may choose to enter the industry from a reward, accounting, or HR-related background. Certainly, we are seeing more people than ever selecting payroll as the sector of opportunity as they aim to establish a successful career in sales, recruitment, or technology. Whatever the route, people committed to advancing their careers in payroll are now not only owning this choice, but they are prouder than ever of the decision.

Let’s Keep the UK Paid!

Written by Nick Day, Managing Director at JGA Recruitment Group

Remember if you need support recruiting Temporary, Contract or Permanent Payroll or HR staff right now, then please get in touch with us! [email protected] | 01727800377